People in Britain are piling into debt as record low interest rates at 0.25% make it extremely cheap to borrow cash.

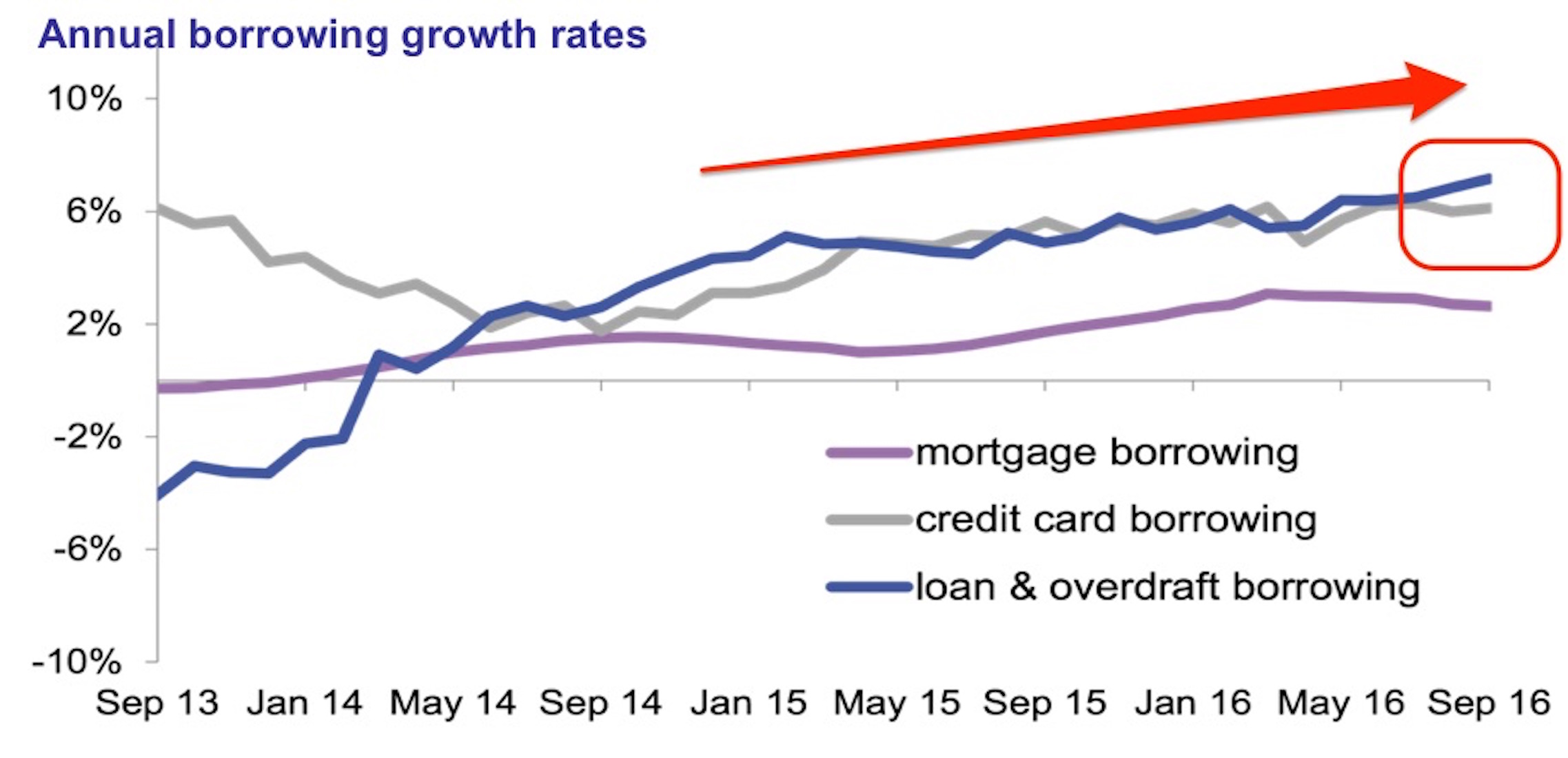

According to the British Bankers Association’s (BBA) “High Street Banking Statistics for September 2016” report, consumer credit – personal loans and overdrafts – showed an annual growth of 6%.

The Bank of England kept rates at a record low of 0.5% since March 2009. It was widely viewed by economists and analysts that the central bank would start raising rates within a year. However, after Britain voted to leave the European Union on June 23, BOE governor Mark Carney took pre-emptive action to keep the economy going by slashing rates to 0.25% on August 4.

Cutting rates makes borrowing cheaper and servicing debt easier. It basically means it gives people more access to cash to spend on things to fuel the economy and making debt more manageable.

"Consumer credit is growing at its fastest rate since December 2006, driven by strong demand for personal loans and credit cards. Consumers are increasingly using short-term borrowing to take advantage of record low interest rates. This trend has accelerated since the Bank of England cut rates in August," said Dr Rebecca Harding, BBA Chief Economist.

However, on the flipside, it looks like the banks are not so confident in lending out huge sums of cash in the event of Brexit. Here are the number of mortgage approvals:

"Mortgage approvals picked up slightly this month but the housing market continues to shows signs of underlying weakness. Both house purchase and remortgaging approvals are down on the corresponding figures for 2015," said Harding.

BBA data shows that house purchase approval numbers are 15% lower than in September 2015.

Meanwhile, businesses are not borrowing as much. BBA data shows that "borrowing by non-financial companies decreased by £0.3 billion in September following a small decline in August."

And this is because of the uncertainty of Brexit.

"Business borrowing decreased slightly again in September, which may be in part down to uncertainty following the EU referendum. There is a longer time lag behind corporate investment decisions so it may take longer for the effect of the interest rate cut to filter through to such borrowing," said Harding.

Britain voted to leave the EU on June 23 and newly installed prime minister, Theresa May, looks to be pushing towards a "hard Brexit." This means Britain leaving the EU without a trade deal with the EU. This is freaking businesses out as it leaves years of uncertainty over what a post-Brexit Britain would look like.

In an audio recording leaked to The Guardian, May warned Goldman Sachs bankers about the potential consequences of a Brexit.

She said it will cause lots of businesses to leave the UK because the nation needs the European Union's trading agreement to keep investment in the country.